Introduction to Manufacturing Finance

The crux of a successful manufacturing business isn’t just about creating stellar products; it’s about understanding the financial mechanics that underpin profitability. The right approach to manufacturing finance can exponentially increase the bottom line while ensuring sustainable growth in an evolving market.

At the heart of manufacturing, finance is critical metrics such as Cost of Goods Sold (COGS), Break Even Point, Gross Profit Margin, and Product Profitability. These elements form the foundation of your Pricing Strategy and ultimately, the financial health of your business.

How to Increase Profit Margins in Manufacturing?

Profitability is not accidental but a result of strategic planning and cost management. Increasing profit margins in manufacturing involves a nuanced understanding of your Cost of Goods, overhead expenses, an effective pricing strategy, and efficient manufacturing operations.

The first step to improving margins in manufacturing is to revisit your COGS. This metric includes direct labour costs, raw materials, and any other direct costs associated with producing your goods. Lowering your COGS could involve negotiating better deals with suppliers, optimizing production processes, or investing in more efficient machinery.

Simultaneously, exploring strategies for increasing product prices without negatively affecting demand is critical. This may require a deep understanding of your niche and what value your customers place on your products, service and you as their supplier.

How to Workout Your Cost of Goods in Manufacturing?

Cost of Goods Sold is a vital metric that, when effectively managed, can help boost your Gross Profit Margin. To calculate your COGS, start with the cost of raw materials and add direct labour costs involved in the production and any other costs directly attributable to manufacturing or selling the product (typically these are your variable costs).

Understanding your COGS can provide insight into how to increase profit, whether through streamlining production, reducing waste, or finding more cost-effective suppliers. Additionally, an accurate COGS calculation is crucial when developing an effective pricing strategy, ensuring that the price point of your product covers costs and contributes to overall business profitability.

How to Workout Your Break-Even Point in Manufacturing?

The Break Even Point is a fundamental concept in finance and an essential component in assessing a business or product’s profitability. The break-even point is the point at which total revenue from sales equals the total costs of the business or product – both fixed and variable.

To calculate your Break Even Point, divide your fixed costs (such as rent, salaries, and equipment) by the price per unit minus the variable cost per unit (or the contribution margin per unit). The resulting figure indicates how many units you need to sell before you start making a profit.

Understanding your Break Even Point enables you to set realistic sales targets and provides a clearer picture of the financial trajectory of your business or product. It’s an invaluable tool in decision-making and setting future business objectives.

How to Improve Gross Profit Margin in Manufacturing?

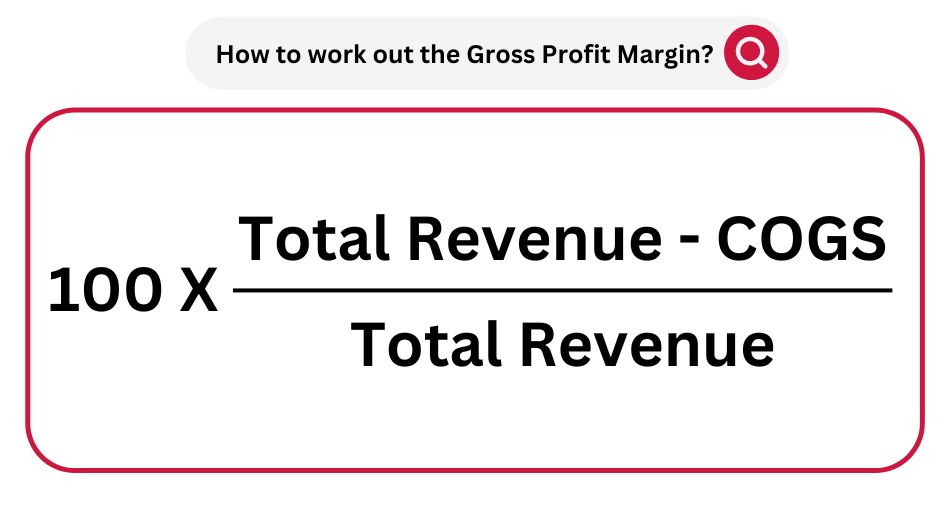

Gross Profit Margin measures the percentage of revenue that exceeds the COGS. It is calculated by subtracting COGS from total revenue, then dividing that number by total revenue, and multiplying the result by 100 to get a percentage.

Improving your Gross Profit Margin involves either reducing your COGS or increasing product prices. However, this needs to be done carefully to ensure that cost reductions do not compromise product quality and that price increases do not deter customers. Innovations in operational efficiency, leveraging economies of scale, and offering premium-priced products are just some strategies to improve your Gross Profit Margin.

The importance of understanding your Business’s Finances

Understanding your financial metrics – Break Even Point, COGS, and Gross Profit Margin – and applying an effective Pricing Strategy are integral to maximizing manufacturing profits. Each plays a pivotal role in determining Business and Product Profitability and the potential for business growth. As a business owner, having this knowledge will empower you to make strategic decisions that will improve margins in manufacturing and ultimately, bolster your bottom-line profits.

Remember, increasing profitability is a journey, not a destination. It requires constant monitoring, adjustments, and improvements to your financial and operational strategies. Adopting efficient production methods, maintaining a keen eye on costs, and implementing strategic pricing policies are all part of this journey.

In addition, it’s crucial to stay abreast of market trends and customer behaviour. Your pricing strategy and manufacturing costs should reflect current market dynamics. Understanding your customer’s willingness to pay and balancing it with your products and service’s perceived value will aid in setting a profitable price point.

Moreover, improving margins in manufacturing means something other than cutting corners that can compromise product quality or customer satisfaction. Instead, it’s about optimizing resources, enhancing efficiency, and delivering value to customers.

Investing in a robust financial management system or working with a finance professional can be beneficial. They can provide detailed insights and reports into your business’s financial health, allowing you to make data-driven decisions.

Keep in mind that financial management is an ongoing process of planning, monitoring, analyzing, and controlling financial resources. When effectively managed, your finances, can transform your manufacturing operations, drive profitability, and provide a sustainable competitive edge.

In conclusion, understanding and leveraging key financial metrics is paramount in the manufacturing sector. By focusing on the Break Even Point, Cost of Goods, Gross Profit Margin, and devising an effective Pricing Strategy, businesses can maximise profits and ensure continued growth and success in the marketplace.